Levy Framework

Legislative Background

Section 92 of the Maritime Area Planning Act 2021 (MAPA 2021) requires MARA to establish a levy framework determining the relevant levy to be paid by the holder of a Maritime Area Consent (MAC) for the occupation of the part of the maritime area for the purposes of the undertaking of the maritime usage the subject of the MAC. This published Levy Framework was agreed between MARA and Minister for Public Expenditure, NDP Delivery and Reform in 2023.

MARA is obliged to keep the levy framework under review and amend accordingly. If the levy framework is amended or replaced, changes must be applied to existing MACs and new MACs unless the framework specifies otherwise.

The Levy Framework

The levy attached to a MAC is calculated by MARA based on the levy framework as detailed below.

The levy framework for the calendar year will be applied to all invoices and charges raised in that year and MARA’s decision in this regard will be final.

The levy framework is updated annually in line with the December figure for All-Items Harmonised Index of the Consumer Price (HICP) values in relation to Ireland, with reference to EuroStat data:

The levy framework provides for two distinct parts:

- Levy Framework, Nearshore, Part A – For MACs wholly within the Nearshore which extends 3 nautical miles into the Maritime Area from the legal high water mark.

- Levy Framework, Outer Maritime Area, Part B – For MACs wholly or partially within the Outer Maritime Area which includes the entire Maritime Area minus the Nearshore.

Levy Framework – Part A

Levy Framework, Nearshore – For MACs wholly within the Nearshore which extends 3 nautical miles into the Maritime Area from the legal high water mark.

Levy Framework Calendar Year: 2025 (Current)

Levy Framework – Part B

Levy Framework, Outer Maritime Area – For MACs wholly or partially within the Outer Maritime Area which includes the entire Maritime Area minus the Nearshore.

Levy Framework Calendar Year: 2025 (Current)

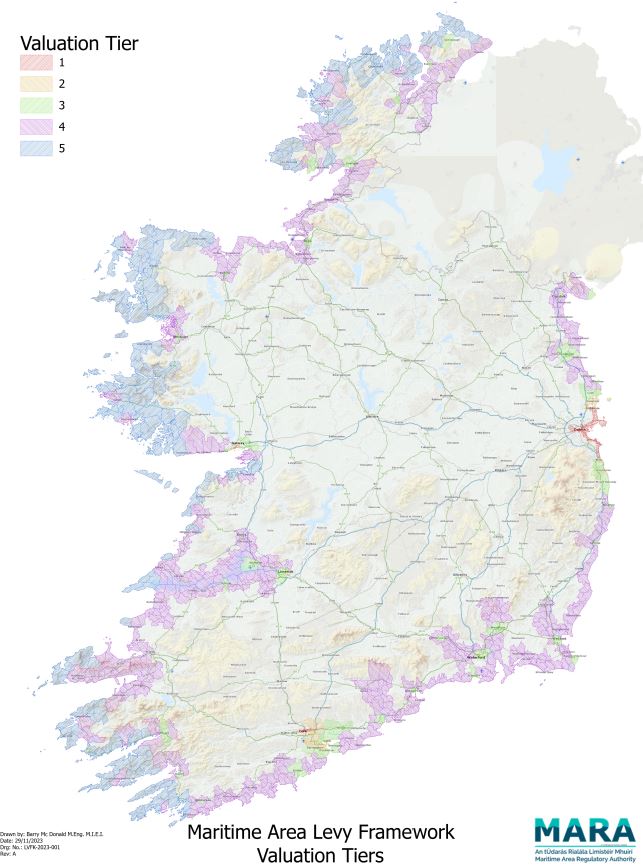

A MAC wholly within the Nearshore is valued using levy framework Part A based on the Tier that it is within or to which it is contiguous. Where a development falls within or is contiguous to two or more Tiers, then a simple average of the value of the two or more relevant Tiers is used. Where a MAC is not within or contiguous to any Tier, then the closest Tier (using a direct straight line) is used to value the MAC.

Levy Tiers have been categorised using Electoral Divisions (EDs) which are defined National Statutory Boundaries. There are approximately 750 EDs contiguous to the Maritime Area and each of these has been assigned to a specific Tier. The relevant Tiers are illustrated in the following map:

The Electoral Divisions can be viewed at CLICK HERE

Electoral Divisions

Further Queries

For further information in relation to the Levy Framework, please contact revenue@mara.gov.ie